Stable Trader:

Stable Trader: AI That Guides Your Market Moves Smartly

Sign up now

Sign up now

In a world of constant market shifts, Stable Trader provides structure and clarity. It integrates broad market movements with short term pauses, giving a balanced perspective of overall rhythm. Noise is carefully filtered so only significant signals inform the insights.

The AI engine observes market pressures and trader behavior, uncovering directional intent with precision. This ensures analytical stability even during periods of extreme market acceleration.

By continuously organizing and adapting data in real time, fragmented information becomes unified intelligence. Stable Trader stays fully analytical, distinct from trading decisions, while highlighting the volatility and risks inherent in crypto markets.

Stable Trader continuously absorbs evolving market information, feeding it into a self correcting analytical framework that reacts instantly. Signals are rigorously checked to maintain consistent judgment and prevent skewed interpretations. Stored sequences of past behavior reinforce understanding, making each analysis smarter and more context aware over time.

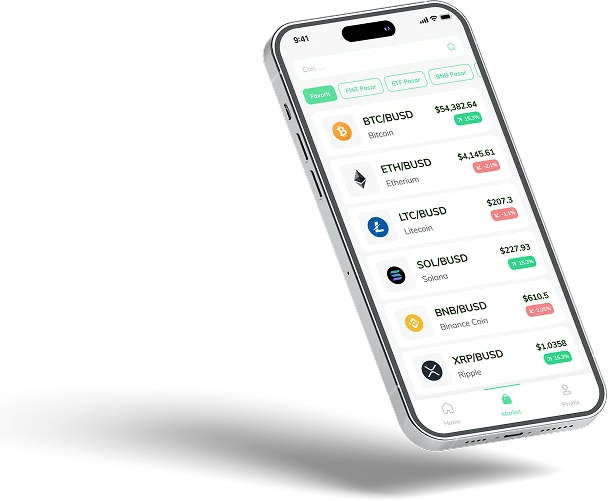

Across Stable Trader, digital asset dynamics are tracked using self adjusting evaluation frameworks. Each market transition is examined for rhythm and impact, turning fluctuations into structured insights that inform measured decisions and precise timing. Evolving momentum and sentiment are met with rigorous pattern analysis to strengthen directional foresight.

Through layered analytical methods, Stable Trader detects rapid market impulses while maintaining overall trend alignment. Examining present shifts against past structures highlights potential inflection moments. Compact decision logic supports stability, clarity, and flexible adaptation as conditions change.

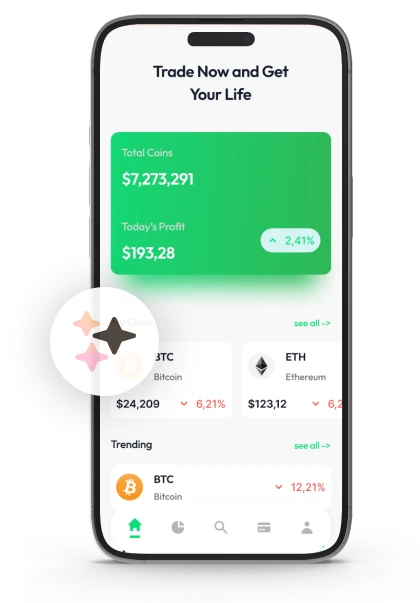

With Stable Trader, users connect to analytical frameworks shaped by aggregated system knowledge. Individual authority remains central, with adaptive indicators informing insights rather than triggering actions. Built in oversight preserves integrity, while intelligent analysis interprets market trends and issues relevant prompts. The platform operates independently and does not engage in trade execution.

Stable Trader prioritizes the protection of analytical information. Detached from exchanges and without executing trades, it uses multi level encryption, controlled permissions, and ongoing verification to maintain a secure, reliable internal network where precision and confidentiality are paramount.

Stable Trader creates a neutral space focused on analysis rather than action. Users retain full decision making control, while advanced tools detect subtle movements and emerging micro trends. Sophisticated tracking converts these nuances into clear, actionable insights. Cryptocurrency markets are unpredictable, and financial losses are possible.

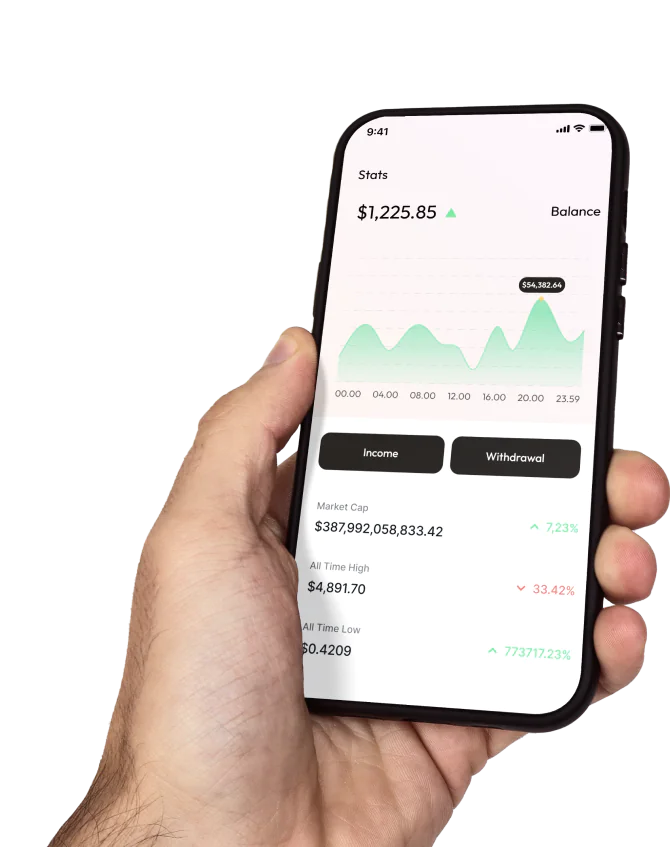

Stable Trader continuously analyzes live market movements. Changes in structure are tracked immediately to keep users aligned with current conditions. When unexpected developments or pattern deviations occur, precise alerts support disciplined monitoring, ensuring clarity even amid continuous global trading activity.

Stable Trader organizes analytical cognition to reduce impulsive reactions and uphold proportional reasoning. Multi tiered frameworks process dense information, isolate structurally significant trends, and anchor stable reference points, ensuring analysis remains reliable during market fluctuations.

With layered intelligence, Stable Trader adapts to market variability while allowing cross condition comparisons. Dynamic inputs are aligned with logical structures to uncover hidden market dynamics, and refined signal pathways prevent distortion, keeping insights uninterrupted.

Historical archives combined with live monitoring allow Stable Trader to track repeated behavior, sentiment cycles, and structural formations in cryptocurrency markets. Real time analysis contextualizes everything from gradual momentum shifts to abrupt reversals.

Running continuously, Stable Trader monitors every significant market shift. Its AI analyzes volume trends, detects unusual patterns, and highlights evolving market sentiment. Insights are assessed in real time, maintaining consistency, clear interpretation, and reliable reasoning across worldwide trading cycles.

Stable Trader offers precise guidance to resolve technical disruptions efficiently, converting challenges into actionable outcomes. Its interface and adaptive workflows support both beginners and professionals. Fully independent of exchanges, it never executes trades, ensuring transparency and reinforced analytical security.

Stable Trader continuously monitors market activity, capturing momentum pulses, trend shifts, and narrative changes, while converting complex data into actionable analytical direction at key moments. Its adaptive computation evaluates force, tracks hidden movements, and maps areas of concentrated pressure, helping users maintain focus without overreacting to surface volatility, even during extreme swings, low liquidity, or large transitions.

Independent of trade execution and exchange platforms, Stable Trader serves purely as an analytical support system. Users remain in control, while the platform surfaces critical inflection points, strategic positioning zones, and contextual opportunities across slow and fast moving markets. Analytical consistency is reinforced through measured evaluation, factual accuracy, and proportional judgment.

Every internal operation within Stable Trader is safeguarded through multi layer encryption and verification. Designed for clarity and secure access, the environment blends structured organization with responsive adaptability. Guided interfaces, modular tools, and stable frameworks maintain operational confidence and continuity under volatile conditions.

Stable Trader uses consistency as its core engine for market momentum. Adaptive matrices, organized input streams, and iterative loops enable reliable evaluation across varying time scales and extended horizons. Archived behavioral data and live mapping reveal persistent trends and pinpoint inefficiencies in current structures.

Real time automated intelligence inside Stable Trader identifies critical variations instantly. Signals support pathway analysis, weighted progression, and proportional adjustments, keeping users aligned with evolving objectives while staying agile amid shifting sentiment and ongoing analytical cycles.

Disciplined structure powers both immediate trades and extended positioning. Stable Trader combines fast paced analytical models with broader contextual cycles, delivering signals that sync tactical execution with directional and timing objectives.

Market strength often forms in concentrated clusters before becoming obvious. Stable Trader tracks rotational patterns and momentum shifts to pinpoint consolidation zones and emerging contraction, enabling early detection of inflection points and better evaluation timing across sectors and global environments.

Rule based logic, clear intervals, and measurable limits provide structured oversight. Stable Trader supports scenario planning, checkpoints, and reassessments, keeping each adjustment anchored, consistent, and aligned with overall market direction.

By combining regime detection with collective analytical insight, Stable Trader distinguishes lasting trends from short term noise. Participation intensity, correlation shifts, and behavioral gradients are tracked to anticipate significant changes. Alerts, documentation, and benchmark updates reinforce discipline, smooth decision making, and maintain situational awareness during active market cycles.

Stable Trader converts digital activity into structured, visual intelligence using advanced tools for range mapping, momentum tracking, and cycle monitoring. Each metric defines speed, reaction zones, and directional pressure, giving participants refined situational awareness and near term clarity.

Pressure boundaries, trend strength, and impulse decay are tracked through integrated frameworks. Stable Trader s refinement logic ensures evaluations are grounded in real evidence, not misleading fluctuations.

Redundancy is removed and structural clarity preserved, ensuring every signal remains precise. Coordinated feedback, segmented validation, and repeatable evaluation paths enhance timing and sequence awareness, creating a disciplined system that strengthens reliability and objective decision making.

Perceptual changes often lead measurable moves. Stable Trader synthesizes social chatter, reports, and commentary into concentrated sentiment models, removing bias and isolating the strongest influences.

Using advanced scanning, Stable Trader identifies emotional inflection points in real time. Elevated optimism may reflect mounting momentum, while fading sentiment can signal energy loss across liquidity conditions, session rotations, and cyclical transitions, where perception typically precedes measurable adjustments.

Sentiment insight complements structural analytics. By analyzing behavioral tone within Stable Trader, users maintain strategic alignment with the market’s rhythm. Cross source comparisons highlight balance points, translate narrative into practical context, and reduce speculative bias, fostering confidence through fluctuating conditions.

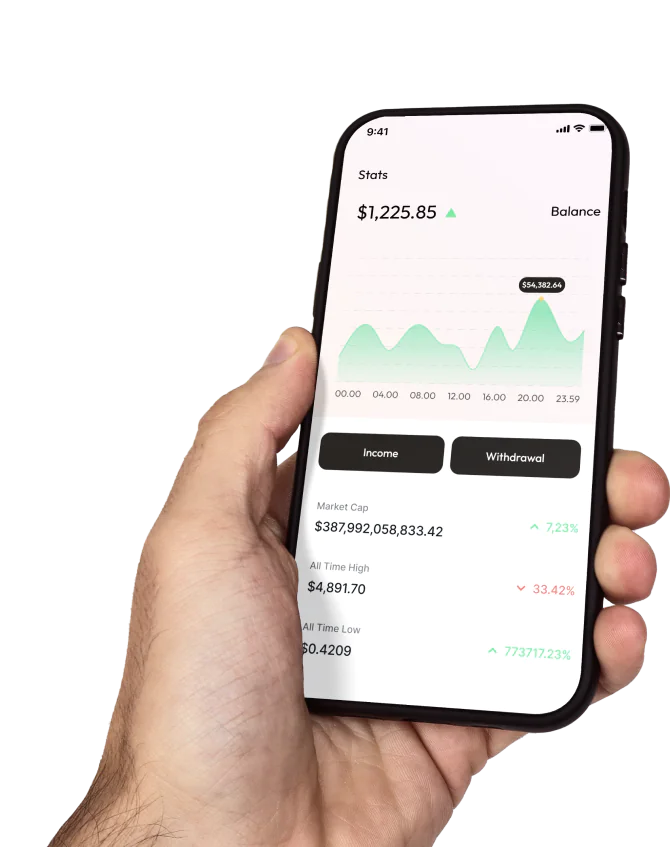

Significant announcements, fiscal changes, interest rate moves, and employment reports, can reshape cryptocurrency valuations. Stable Trader applies advanced AI macro analysis to reveal how these factors influence asset alignment, from decentralized positioning to institutional flows and market sentiment shifts.

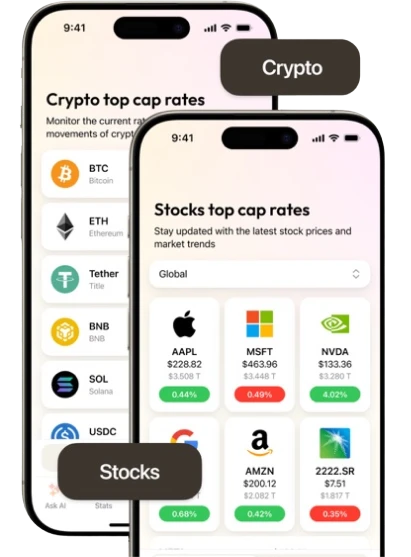

Macro changes often play out over extended periods. Stable Trader integrates historical trends with real time momentum tracking to construct predictive models that sustain decision confidence during volatility spikes, reversal phases, and prolonged uncertainty.

Underlying market rhythms often go unnoticed. Stable Trader integrates extended analytical models with real time tracking, aligning asset movements with technical benchmarks. This creates structured intervals for sharper observation, configuration, and accurate decision making, even amid variable liquidity and volatile conditions.

The system identifies recurring rhythm cycles, structural repetitions, and wave transitions. Each signal highlights timing symmetry, helping users understand how sequential flows shape outcomes through volatility, reversal points, and complex phases while maintaining disciplined, stable progress.

Stable Trader ensures no single market event can disproportionately impact your outcomes. Using AI correlation analysis, it maps portfolio responses under stress, highlighting asset convergence and divergence during high pressure scenarios.

By removing distortion, Stable Trader detects directional signals before they become obvious. Early recognition of accelerations, compression, and stress markers allows structured, preemptive action instead of reactive momentum chasing.

Market energy often accumulates quietly before visible shifts. Stable Trader isolates authentic momentum from background noise, keeping attention on verified market dynamics.

Sudden surges, hidden pullbacks, and erratic trends are decoded by AI powered analytics. Stable Trader converts apparent market chaos into actionable insights, enabling confident observation and structured decision making.

Stable Trader fuses accelerated analytics with methodical frameworks to deliver clarity in turbulent markets. Incoming sequences are structured, interpreted, and converted into actionable insights that track momentum, recurring cycles, and underlying system balance.

Responsive to participant inputs, Stable Trader adjusts dynamically to market conditions. Every iteration captures live variability without compromising analytical structure, providing stable guidance and controlled orientation even through unpredictable market phases.

Stable Trader leverages AI powered models to distill massive datasets into organized, interpretable segments. Hidden behavioral cues are revealed, transforming noisy information into actionable insights for confident decision making.

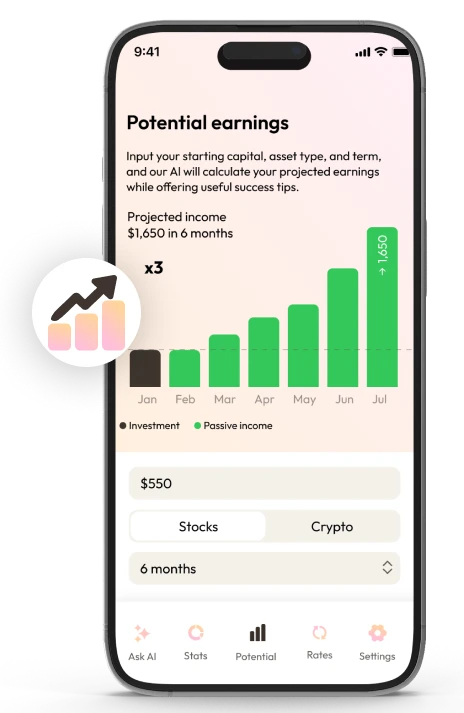

Whether you are a first time analyst or a seasoned strategist, Stable Trader provides an adaptive interface that simplifies complex cycles and dense data streams. Features are designed to focus attention, improve understanding, and ensure consistent orientation at every experience level.

Completely independent from trading platforms, Stable Trader never executes trades, ensuring unbiased analysis. Its system emphasizes transparency, contextual insight, and structured reasoning rather than enforced conclusions, delivering reliable awareness across diverse market environments.

| 🤖 Entry Fee | No entrance fee |

| 💰 Incurred Costs | Free of any charges |

| 📋 Process of Joining | Registration is streamlined and fast |

| 📊 Subjects Covered | Education on Crypto assets, Forex markets, and Investment strategies |

| 🌎 Eligible Countries | Almost all countries are supported except the US |